Did an “invisible blockade” by the United States fatally undermine the Chilean economy under the presidency of Salvador Allende (1970-73)? Did it actually work? Short answer: No.

Note: this post is not about the wider US involvement in the September 1973 coup or about the regime of General Pinochet. It’s about the economic and financial dimensions of US-Chilean relations during the Allende years. (Edit: For a short post on post-Allende Chile, see my “There was no Chilean miracle“.)

On the eve of the violent military coup against Salvador Allende on 11 September 1973, Chile found itself in unprecedented economic chaos. Shaken by hyperinflation, widespread shortages, and labour unrest, the “Chilean road to socialism” might have been doomed by simple economic collapse, even if the coup had never taken place. But for many people it’s an article of faith that the United States was deeply responsible for the destabilisation of the Chilean economy. In that narrative, the Nixon administration had imposed an “invisible blockade” against Chile, a multi-front economic war conducted by an alarmed imperial hegemon bent on aborting the first democratic socialist experiment in Latin America.

On the eve of the violent military coup against Salvador Allende on 11 September 1973, Chile found itself in unprecedented economic chaos. Shaken by hyperinflation, widespread shortages, and labour unrest, the “Chilean road to socialism” might have been doomed by simple economic collapse, even if the coup had never taken place. But for many people it’s an article of faith that the United States was deeply responsible for the destabilisation of the Chilean economy. In that narrative, the Nixon administration had imposed an “invisible blockade” against Chile, a multi-front economic war conducted by an alarmed imperial hegemon bent on aborting the first democratic socialist experiment in Latin America.

But was the “invisible blockade” actually successful? Did it cause, or contribute substantially to, Chile’s shambles in 1972-73? This narrower question of the actual economic impact of the ‘blockade’ has gotten lost in the shuffle of the larger question of US culpability in Pinochet’s coup.

In this post, I argue, regardless of whether the “blockade” was as extensive or as maliciously intended as its maximalist critics allege, it did not make any difference.

(1)

The controversy about the US involvement in Chile peaked in the 1970s immediately following the coup and in the wake of the Church committee hearings in the US Senate. But it has periodically flared up in tandem with coup anniversaries, the arrest of Pinochet in London, his prosecution in Chile, his death in 2006, etc. At the same time, there’s been a steady stream of books and articles dealing with US interference in Chile which mention the ‘blockade’ mostly in passing. Yet these usually assume as a matter of course that it must have ‘worked’.

For example, Peter Kornbluh’s The Pinochet File, now in its second printing (2013), combines a narrative of Yankee shenanigans with fascimiles of declassified US government documents relating to Chile. Amongst those are Richard Nixon’s hand-written instruction to the CIA to “make the [Chilean] economy scream“; or Henry Kissinger’s infamous National Security Memorandum 93, calling for economic and financial measures against Chile. The steps outlined in that memo bear close resemblance to what the United States actually did.

And such documents are essentially regarded as prima facie evidence for the efficacy of the “invisible blockade”. Or most people just don’t really give it much thought and default to the conventional view you can find by googling the “invisible blockade” (e.g., 1, 2, 3, 4, etc.)

The literature on Chile in 1970-73 is incredibly large. Yet the part that’s specifically on the ‘blockade’ that I’m aware of is quite modest in comparison:

- Farnsworth et al., Facing the Blockade (1973) (Spanish translation in PDF).

- Paul Sigmund, “The Invisible Blockade and the Overthrow of Allende” (1974) (Spanish translation in PDF).

- Exchange between Farnsworth and Sigmund in Foreign Policy (1974).

- pp 79-118 of Petras & Morley, The United States and Chile: Imperialism and the Overthrow of the Allende Government (1975)

- Farnsworth et al. “The invisible blockade: the United States reacts” in Chile: Politics and Society (1976), pp 338-373.

- Petras & Morley, “On the U.S. and the Overthrow of Allende: Reply to Professor Sigmund’s Criticism” (1978)

- Sandro Sideri, ed., Chile 1970-73: Economic Development and its Interational Setting (1979).

- chapter 4 of Gonzalo Martner, El gobierno del presidente Salvador Allende 1970-1973 (1988);

- pp 200-241, Mark Falcoff, Modern Chile, 1970-1989: A Critical History (1989).

Except for the Sideri volume, this ‘blockade’ literature is about financial politics and diplomacy, not economics. They dwell on (a) the motivations of the US government, various private banks and corporations, the multilateral financial institutions, etc.; and (b) the minutiae of Chile’s external financial relations in the years 1970-73, such as the Paris Club negotiations over the country’s external debt, World Bank deliberations, legal proceedings related to copper, etc.

The ‘blockade’ literature seems to agree on the following :

- US foreign aid to Chile fell dramatically in the Allende years. This included long-term development loans (USAID), trade finance (Eximbank), etc.

- During Allende’s tenure, no new loans were originated by the World Bank, and the amount of loans from the Inter-American Development Bank fell dramatically. Chile had been a major beneficiary of both institutions before 1971.

- At the end of 1971, the Allende government announced a moratorium on the servicing of foreign debt (mostly owed to US banks).

- There was a gradual reduction, not a total elimination, of lines of credit from US private banks which normally financed Chile’s imports on a short-term basis.

- There was no embargo on trade, but Chile had to pay for imports in cash upfront, in proportion to the loss of trade finance.

- The Allende government completed the nationalisation of the copper mining companies initiated by the previous administration (Frei), but decided not to compensate the mostly U.S. owners.

- US copper companies attempted in various jurisdictions, including France, to attach Chilean copper shipments, but this met with only partial success.

- Chile was able to obtain aid and credit from alternative sources in Western Europe and Latin America, as well as the socialist bloc.

Sigmund and Falcoff, who might be called ‘anti-blockadists’, argue there was no blockade because there wasn’t a total cut-off in aid and credit. And the “credit squeeze” by private banks was not politically motivated, but largely a legitimate financial response to Chile’s deteriorating credit-worthiness. They also argue alternative sources of aid and credit went a long way in compensating for the loss of traditional sources.

The ‘blockadists’ Farnsworth and Petras stress that before Allende, Chile had always relied on external aid and credit to cover balance of payments shortfalls arising from the volatility in the price of its main export, copper. They also argue — reasonably — that numbers alone don’t tell the whole story, because the scarcity of short-term credit restricted Chile’s ability to obtain from the United States spare parts for critical industries. Much of Chile’s equipment stock was US-made and required American parts.

(2)

Sideri (1979) is the only one that contains a semblance of economic analysis. Otherwise, as far as I can tell, none of the multitude of papers and books written by economists about Chile since 1970 even mentions the “invisible blockade”. At least you won’t find it in the works of economists like Ffrench-Davis, Bosworth, Meller, Dornbusch, Edwards, Larraín, etc. (I’m open to correction on this point.)

But there’s a good reason for this silence — it’s difficult to take seriously the idea that the “invisible blockade” had much to do with this:

[Source: Larraín & Meller in Dornbusch & Edwards; unless otherwise noted, other tables below come from the same source.]

The CPI inflation rate of >600% in 1973 actually understates the true rate, since retail prices were subject to controls under the Allende government. According to Larraín & Meller, the wholesale price index rose 1000% in 1973; and black market prices were five to ten times higher than official retail prices. And here is the proximate cause of the inflation (click to enlarge):

The Allende government’s budget deficit (fourth-to-last line, “overall surplus”) was 15%, 25%, and 30% of GDP in the years 1971-73. That’s massive! Greece at its worst in 2009 hit 15% of GDP. If the United States had budget deficits equal to 30% of GDP, that would amount to $5 trillion — more than three times the actual US budget deficit at its nominal peak in 2009.

But more importantly, the last line (“net internal financing”) shows that the Allende government cranked up the printing press. Almost the entire budget deficit was financed by money creation.

The largest single factor in the deterioration of public finances as of 1971 was clearly the higher spending on wages and benefits. This was a deliberate part of the populist programme of the Allende government to achieve income redistribution by raising nominal wages while freezing or even reducing menu prices.

By the end of 1972, however, inflation was eating into tax revenue in real terms (i.e., the Olivera-Tanzi effect). And the international price of copper, Chile’s main source of foreign exchange earnings, was 25% lower in 1971-72 than in 1970, until it recovered in 1973. [Bosworth et al., Table 1-1, pp 32-33.] Combined, these two effects eventually cost the Chilean treasury about as much as the increased spending on wages and benefits.

By 1973, the single biggest factor behind public sector deficits was the subsidy to state-owned enterprises other than copper. The Chilean government had, de jure or de facto, nationalised large portions of the private economy :

In 1973, the Chilean state made up for losses in non-copper enterprises equivalent to almost 10% of GDP !!! [See the line “subsidies to social area” in table 7.16b, or the more detailed table of public sector finances from Larraín & Meller.] The huge losses were in part due to disruption in production from nationalisation and management problems, but also to the deliberate state policy of lowering retail prices charged to consumers :

For me, this is quite sufficient as an explanation for the catastrophe of Chile in August 1973. Expenditure on wages, benefits, and industrial subsidies, combined with the falling price of copper and the inflationary erosion of real tax proceeds, explain nearly all of the 30% of GDP deficit by 1973.

How do you produce such a situation through external intervention ??? Did the CIA install printing presses in the Andes and haul sacks of money by llama to the cities of Chile?

(3)

What about those spare parts that Chile had difficulty importing because of insufficient trade finance? Surely that must have affected industrial production, contributing to the shortages; and affected government revenue via lower output in mining ? Every ‘blockadist’ author emphasises this. And there would be feedback effects: lower output –> lower revenue –> more inflationary finance –> etc.

But the supply side of the Chilean economy in 1971-73 was completely dominated by one fact: in order to curb inflation, the Allende regime resorted to rationing, price controls, and the nationalisation of product distribution. This induced massive shortages, hoarding, and queuing. And the price controls would have contracted output in the residual private sector. The severity of the problem can be gleaned here [from Meller] :

Just before the coup, the black market exchange rate was more than 40 times the official rate! And the growing black market premium seems to track the decline in industrial output :

Just before the coup, the black market exchange rate was more than 40 times the official rate! And the growing black market premium seems to track the decline in industrial output :

It’s more plausible that the mining sector, whose output was declining as early as 1972, suffered from a shortage of spare parts. But without micro-level data on spare parts imports and industry usage, this question can’t be answered.

(4)

Yet there’s another factor. A common corollary to the “invisible blockade” is that the CIA directly or indirectly funded strike action by truckers and trucking company owners, which not only destabilised the country politically, but also caused shortages. The most often cited are those of October 1972, lasting 24 days; and of July-September 1973. But even if the truckers’ strikes had indeed been funded by the United States, they were but a part of the much larger wave of labour discontent in the last year of Allende plaguing a country which had already been fairly strike-prone :

[Both tables 5.3 and 6.10 from Falcoff p. 137-9 and 192-3, respectively] The nation-wide wave of strikes in the summer of 1973 demanding the indexation of wages to inflation was initiated in sympathy with copper miners who walked out for over 74 days and even clashed with police.

It’s difficult to see how this state of affairs can be blamed on external factors. Either hyperinflation was eroding real wages despite large nominal wage increases, or the political ascendancy of the left was raising worker expectations. Socialist and communist labour unions were part of Allende’s Popular Unity coalition, but they often had little control over the workers.

Of course none of this helped the real economy: strikes by miners alone is estimated to have cost about 7-8% of copper export earnings.

(5)

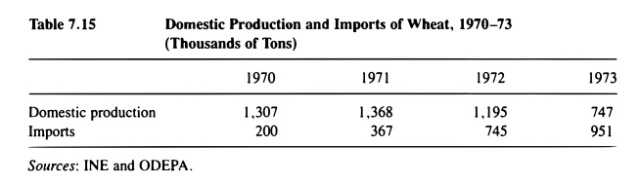

In terms of its balance of payments, two misfortunes coincided for Chile in 1971-72: the aforementioned 25% fall in the world price of copper; and the rising dollar price of imports thanks to global inflation. At the same time, domestic agricultural production was severely disrupted by land reform :

Agrarian reform had begun under the Frei presidency (1964-70), with approximately 20% of Chile’s agricultural land falling under the programme. But with Allende this process was accelerated, and the political atmosphere also incited spontaneous occupation of lands by peasants. In all, “[b]y mid-1972, practically all privately owned farms of over 80 basic hectares had been eliminated”, and by 1973 additional 40% of Chile’s agricultural land had been nationalised. The nationalisations were supposed to be a temporary measure before reorganisation and redistribution to peasants, but owing to the scale and complexity of the process very little of the land had been transferred on the eve of the coup. [Larraín & Meller, pp 185-7]

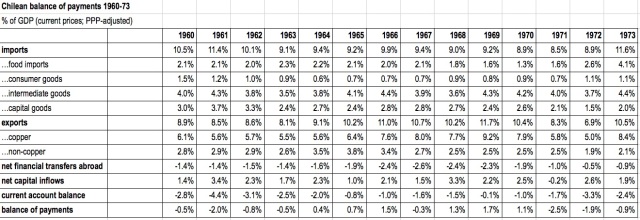

Therefore, Chile’s export earnings in dollars both fell because of lower copper prices and commanded less purchasing power — at a time when there was a rising demand for food imports. Here is Chile’s balance of payments for 1970-73 [from Meller] :

I think most readers of this blog know how the balance of payments works, but just in case: a current account deficit must be covered by inflows of hard currency, e.g., foreign loans, or foreign charity, or flows of investment capital into the country. If total inflows are insufficient, then the balance of payments deficit must be met out of reserves at the central bank. The last line in Table 1.13 is equivalent to a draw-down of reserves.

In one year, 1972, the higher food import bill was clearly met partly by importing fewer capital and intermediate goods, a category which includes spare parts. So if the “credit squeeze” did anything, it was to force upon Chile a choice between paying cash upfront for those goods and paying cash upfront for the extra food. The Allende government understandably chose the latter.

Had Chile not been obliged to import so much extra food as a result of its own disorderly land reform, then it would not have had any difficulty on the spare parts front even with the falling price of copper. As far as I know, no one has ever before made the connection between Allende’s agrarian programme and the country’s difficulties in importing capital & intermediate goods.

(5)

Farnsworth (1974) argued :

I took the 1960-73 balance of payments data from Banco de Chile, which are given in nominal US dollars; and with nominal GDP in PPP-adjusted dollars (tcgdp) for Chile from the Penn World Tables, I made a table of BOP values as % of GDP (click to enlarge):

It is true Chile had to live off reserves more in 1971-3 than in 1960-70, and this depletion of reserves was obviously unsustainable. So on the eve of the coup in September 1973, Chile was well on its way to a balance of payments crisis. But it had not had one yet. Chile throughout the Allende years was able to make ends meet.

However, except in 1971, when there was private capital flight out of Chile, the net capital inflows into Allende’s Chile were not substantially different from the 1960s. And the moratorium on debt servicing to the United States, its largest creditor, saved on foreign exchange — the financial transfers not made by Chile increased the “de facto capital inflows”. So even if, as Farnsworth argues, Chile was forced to live off reserves for three years, it was because of higher food imports and lower copper prices; not because of the “credit squeeze”…

Moreover, Chile was able to obtain new credit facilities from Western Europe and Latin America, even though the credits were often tied to the purchase of imports from the creditor countries. This forced Chile to reorientate its trade away from the United States and toward Europe, Latin America, and the socialist bloc. This is why Chile’s external debt actually rose from ~$2 billion in 1970 to ~2.7 billion in 1973.

[Sources: Table XVI from Sideri pg 43 and Table 3.17 from Sideri pg 101.]

(8)

The “invisible blockade” does not make much sense as a story. From a bird’s-eye macroeconomic perspective, any supply shock relating to spare parts would have been at best a drop in the bucket. From a terms-of-trade perspective, it was the need for more food along with the falling price of copper which caused the Allende government to ration its own foreign exchange in favour of food. From a purely balance of payments perspective, the moratorium on foreign debt service mostly made up for the loss of capital inflows that had been previously made available by the United States, multilateral institutions, and private banks in the 1960s. Despite all this, Chile still dipped into reserves.

It’s true, if Chile had received even more capital inflows in 1971-73, its excess import demand would not have been constrained by foreign exchange. But that’s kind of like saying, the socialist revolution needed financing from the imperialists…

Addendum (7 August 2016): I recently wrote a short post on post-Allende Chile. I think Chile in general, but Pinochet’s economic reforms especially, is kind of overrated.

Update (26/7/2020): UnlearningEcon has a Medium post on (what else?) another metaphysical critique of economics which has a fleeting reference to this my post on Chile. Although he instances my post as an example of something he approves of methodologically, he also cautions: “[Pseudoerasmus] fails to include that fact that the US dumped its copper holdings — Chile’s main export — which played a role in destabilising the economy”.

Rapley, the first source, says this:

Rapley’s own source (the second link) is Kaufman, who observes:

The source for Kaufman’s claim is the 15 May 1973 issue of Chilean Economic News which I’m unable to access.

Unfortunately, this claim is a simple factual error.

In The Foreign Relations of the United States 1969–1976, Volume XXI, Chile, 1969–1973, there is a memorandum written by Henry Kissinger on 2 January 1971 to Richard Nixon, proposing the sale of the US strategic reserve of copper in order to hurt Chile. He notes this action would (1) require Congressional approval and (2) probably not have a great impact, since the US stockpile was at most 3% of the world’s annual production. On 17 April 1973, Nixon finally announced plans to sell the US stockpile of a variety of strategic raw materials, copper amongst them, but over the course of several years.

So in other words, the US strategic stockpile of copper was small, and it could not have had much impact on world copper prices. But the sale didn’t even happen until 1973! Note that copper prices had started falling in 1970 and by 1973 it had already been rising again.

The small objection by UnlearningEcon is an example of inattention to historical detail which apparently characterises both mainstream and heterodox economists 🙂

I often heard the argument from Left that US was behind the falling international price of copper, manipulating world copper market to punish Chile

LikeLike

It’s true, if Chile had received even more capital inflows in 1971-73, its excess import demand would not have been constrained by foreign exchange. But that’s kind of like saying, the socialist revolution needed financing from the imperialists…

Well, the solution to that problem is for the U.S. to become a socialist republic. Then it would be internationalist solidarity rather than imperialist charity.

LikeLike

Great post. The Chilean coup has become part of the whole “Revolution That Failed” complex you see among the Jacobin leftist set, with the Good Allende being toppled by the Bad Old US. Turns out, though, he was just incompetent and the Chilean macroeconomy was run terribly during his presidency.

LikeLike

Could always bbe both….

LikeLike

Pingback: La macroestafa de las tiranías | Sabiduría Herética

Pingback: La caída de Allende: una versión heterodoxa | Las2Orillas.CO

Another way of saying this would be that the invisible blockade failed, and the price of copper was clearly not going to remain at those artificially depressed levels, so a coup was deemed necessary. Pinochet never gave back the mines, which still underwrite the government and liberal spending in the Chilean public sector.

LikeLike

Actually my original title was going to be “Wait, but didn’t the Invisible Blockade fail ???”.

What do you mean copper prices were “artificially depressed” ? They started rising again some time in 1973 if I recall correctly, and the rising prices helped the Pinochet regime.

But commodities go through short- and medium-term cycles (although over the very very long run they have a downward trend).

Yes, there’s always been consensus that the mines should be nationally owned, and of course a part of the nationalisation process (50% of the copper assets) was initiated before Allende.

And, yes, Chile is still highly dependent on copper — which in my opinion shows what an overrated country it is generally — regardless of the regime type (pre-Allende, Allende, Pinochet, post-Pinochet).

LikeLiked by 1 person

Because the coup had nothing to do with Allende’s decision to use tear gas on the wives of the military officers, leading to almost unanimous antipathy to Allende in the military? On the one hand you seem to want to argue that Pinochet and the Chilean military were mere stooges of the US imperialists, who followed marching orders for Washington to overthrow their own government. And on the other hand you seem to want to argue that Pinochet thwarted the primary aims of those imperialists.

Or, yet another way of interpreting this data is that the US had relatively limited leverage over Chilean internal politics, and regardless of its aims had little ability to sway Chilean politics. Consequently – and logically and exactly as you might expect if you aren’t some sort of racist – the coup against Allende was largely planned and motivated by Chilean citizens who had their own motives for doing what they did, and were largely reacting not to US “imperial” pressures but the actions and decisions of other Chilean citizens, and the whole narrative about Caucasians masterminds in Washington manipulating the brown skinned simpletons pushed by the left, is just a bunch of racist BS propaganda offered up in defiance of the facts rather than as a result of considered examination of them.

LikeLike

This is a very strange comment. Did you actually read what I wrote? I do not say or imply that the coup was cooked up in Washington! To the contrary, my point is that Allende, not the USA, created the conditions which set the stage for the coup !!! As for the US involvement in the 1973 coup, there’s still not that much evidence of a direct involvement, although that the USA was involved in the attempted 1970 coup is well documented. But whatever its involvement, the USA could never have just magically conjured up a coup even if it had tried ! The coup was indigenous.

We agree yet you have somehow hallucinated that we disagree !

LikeLike

Pseudoerasmus: You confusion can be most easily explained if you notice and assume that I wasn’t in fact replying to you. (Reply up here, because I see no reply button to your comment.)

LikeLike

Apparently he’s saying I’m the racist propagandist.

LikeLike

Pingback: Come fallì l’economia populista di Allende - IMDI.it

Pingback: Funcionó el ‘Bloqueo Invisible’ contra el Chile de Allende? | Katalepsis

Pingback: 11 Settembre 1973 – Il golpe di Pinochet |

Pingback: Dólar peso después del Rechazo – Stakeholderz