British Tariff Protection after 1774: Competition, Innovation, & Misallocation, plus a note on Weaving

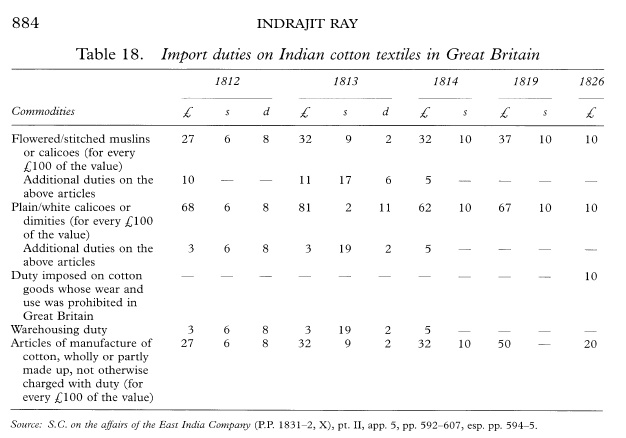

This is an addendum to a post about the Calico Acts, which had prohibited within Britain the consumption of cotton cloths both foreign and domestic. But even after their repeal in 1774, Indian cloths entering the British market continued to face stiff import duties, ranging from 27-59% ad valorem in 1803 to 71-85% in 1813.

Although the Calico Acts are frequently discussed by Western scholars, the protection of the British cotton industry that continued until the 1820s is something only Indian scholars bother to mention.

In the other post, I argued that the Calico Acts probably hampered and delayed the rise of the British cotton industry. But is it possible that tariff protection was necessary for this later phase of British cotton after 1774?

[Source: Ray 2009]

It’s universally acknowledged that British industry became globally competitive in all varieties of cotton cloth only some time in the 1820s [Clingingsmith & Williamson 2008; Broadberry & Gupta 2009]. Indian labour was cheap, and until the 1820s, British costs were still higher on average because automation in the industry remained quite partial.

The mechanisation of carding and spinning was already in full swing by the 1780s, but you only got the self-acting mule (for spinning) in the 1820s. Printing and other linkages in cloth production were still in the early stages of mechanisation. Weaving continued to be dominated by hand processes.

During those 60 years of technological evolution and learning-by-doing, the new cotton factories became increasingly more capital-, scale-, and energy-intensive.

So it’s plausible, a priori, that protection gave the British cotton industry in 1770s-1820s the necessary “breathing space” to develop its competitiveness.

On the other hand, the infant-industry argument is typically about protecting a new industry in a technological follower or laggard country against competition from a technological leader country possessing a first-mover advantage into increasing-returns-to-scale production. In this case, Britain was the clear technological leader over India (and everyone else). Mechanisation and automation in British industry was just not fast enough to fully overcome India’s labour cost advantage before ~1830.

Then it’s also plausible, a priori, that tariffs on Indian cottons in the late 18th and early 19th centuries helped slow the development and diffusion of cost-reducing technology in the British cotton industry.

This is suggested by a striking feature of the cotton industry during the industrial revolution.

Firm Size & Misallocation

Different ‘stages’ of technology in all three spinning, weaving, and printing coexisted for decades in Britain during the Industrial Revolution.

In spinning, yarn was spun with water-powered Arkwright frames alongside hand-powered mules and jennies. As Chapman (1970a) put it:

…the structure of the early cotton industry in Lancashire and the North West showed unusual polarisation: a small number of merchant-manufacturers (50 or 60 in 1795) eagerly seized on Arkwright’s lucrative system, while a much larger number of small men struggled with a carding engine and a few jennies (or a mule or two) to maintain their place in the industry, and expanded their investment only by the closest devotion to business and the most ascetic living habits.

Berg covers similar ground:

In 1780 Britain had no more than 15 or 20 cotton mills, and seven years later there were 145 Arkwright-type mills. Before the end of the eighteenth century there were 900 cotton-spinning factories. These ranged, however, from 300 Arkwright-type factories—purpose-built buildings of several stories employing over fifty workers—through 600 ‘factories’ using jennies and mules, some of which were little more than sheds or workshops employing around a dozen workers.12 The industry’s capital in the late 1780s was still predominantly spread over hand or domestic processes, especially weaving.” (p32)

“There survived, however, a number of little workshops with a carding engine, a few spinning jennies, and hand-, horse-, or rudimentary water-power mechanisms. The roomletting or floor-letting system used in Manchester and Stockport was common, and one mill in Stockport had twenty-seven masters employing 250 people in total.75 These were often small businesses which later grew much bigger. Just as often, however, they were second or third mills owned by risk-spreading and diversifying firms. A firm maintaining several mills of varying scale could experiment with new techniques either in its larger factory or in one or two of its smaller mills. Either way, it would avoid the risk of losing everything. Overall averages confirm this picture. As late as 1835, Ure calculated that the average cotton mill employed 175.5 people.” (p201)

The above refer to factories/mills, not firms, and some large firms owned several factories to spread the risk or try different methods at different locations.

However, Chapman (1970b), exploiting insurance records for cotton firms in the 1790s, reveals a large dispersion in firm size. Those firms valued at more than £5000 numbered two dozen or so, with the largest being vertically integrated operations like the Peels that started from raw cotton and finished with printed cloth. But there is a much larger number valued at a couple of thousand pounds and below, with a dozen or so in Stockport (Manchester) valued at a mere £100.

It’s possible to take all this as evidence that the minimum efficient scale and therefore the barriers to entry were still quite low in cotton. And indeed there was a rapid turnover of firms in the period 1785-1840 (Harley 2012). But it’s also possible that the tariff lowered the MES by raising the price of cloth and keeping less productive firms in business. If that’s true, and if we assume that scale is an indicator of firm-level productivity, then this large variation in firm size and technological adoption is also evidence of misallocation — too much labour and capital was tied up in relatively lower-productivity firms.

The Slow Mechanisation of Weaving

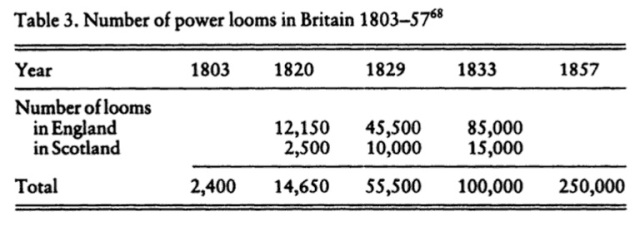

The mechanisation of weaving after 1790 was perhaps even slower than spinning in 1770-90. Although Cartwright is credited with inventing a power loom circa 1785, the first commercially successful one was patented in 1803 by Horrocks and even then it was decades before power looms were widely adopted.

Between the 1790s and the 1830s, the hand loom sector was not just bigger than the power loom sector, but it also actually expanded in size. The lag in mechanisation between spinning and weaving meant there was a lot of cheap yarn leading to the weaving boom of 1780s-1815. Cotton hand weavers quadrupled in number (Brown 1990) as farmers took up weaving full-time and, for the highest quality cloths, the wage more than tripled (Allen 2016).

[Source: Hills (1989), pg. 117. In 1823, there were 240,000 to 250,000 hand looms according to Ray (2009).]

Although a power loom was about three times as productive as a hand loom, hand weavers were needed for the finer printing cloths as machines could not yet reproduce the quality of the hand looms. So the small mechanised sector focused on the coarser, cheaper cloths, often for export markets, whilst the larger hand loom sector wove the finer fabrics that most directly competed with Indian goods.

Traditionally, the slow mechanisation of weaving is attributed to exogenous, purely technological issues in power loom development (Rose, pp 45-7). But the late protectionism in the British cotton industry, to the best of my knowledge, has never been mentioned as a possible factor.

What ever the case may be, the boom in hand-weaving was certainly helped along by the tariffs still restricting Indian textiles in the early 19th century. These protected the hand weavers and kept the prices of finer fabrics higher than they would have been under free trade. This implies more resources were allocated to producing finer fabrics than coarser fabrics.

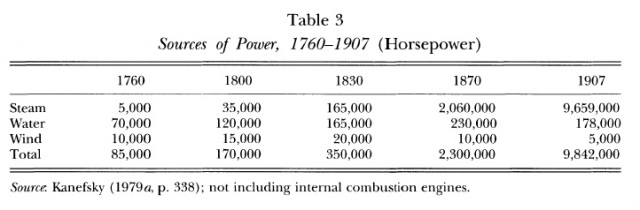

As is well known, the steam engine also diffused more slowly than widely believed, and to the extent that the power looms were driven by steam, protective tariffs may have delayed the diffusion of both.

[Source: Crafts 1994]

In that scenario, the tariffs on Indian goods should be seen in the same light as the Corn Laws, which certainly kept more resources tied up in agriculture. Then British trade policy was de facto Luddite, an unintentional complement to the machine breakers.

Under free trade, cheaper Indian cloths of the finer grades might have wiped out British hand loom weaving in the worst case scenario, but certainly the yarn sector would have more than survived. British machine-spun yarn never faced any obstacle to its development from any foreign competitor, because Britain imported almost no cotton yarn (Hoffmann pp 255-7). In the late 18th century, Britain’s mechanised spinning sector produced much more yarn than could be absorbed by its weavers, and the surplus was exported (including to India). In fact, British yarn imported into India may have helped temporarily retard Britain’s competitive edge over India in cloth. [Ray 2009]

But does it matter that Britain might not have had a large hand-weaving sector under free trade? One might say: who cares if hand loom weavers had been wiped out in 1800? They eventually got wiped out anyway, just more slowly.

However Allen (2016) argues, using his usual directed technical change perspective, that high wages for weavers induced by the boom were absolutely necessary to the invention and adoption of power looms. But Allen also has nothing to say about the effects of competition on incentives to originate innovations or adopt them.

Competition & Innovation

Economic theory is generally ambiguous about the relationship between competition and innovation.

On the one hand, everyone agrees that firms need some degree of monopoly rents (i.e., profits) as an incentive to finance the high fixed costs of research & development. Either subsidies, tariffs, or just a large market can raise the return to investing in an industry. So “too much competition”, which reduces profits, can be bad for innovation.

On the other hand, abnormal profit levels themselves might encourage new entrants into the industry and drive down profits. [See Grossman & Helpman: sections 9.2, 9.3; also Baldwin (1969) for the ‘appropriability’ problem].

The second effect may predominate if the barriers to entry are very low — and, as already seen above, they appear to have been low for the cotton industry during the Industrial Revolution. We are talking about cotton, not steel.

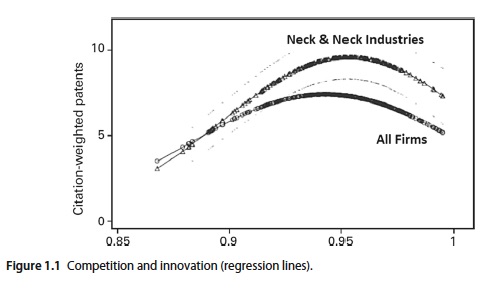

In neo-Schumpeterian growth theories (Aghion, Akcigit, & Howitt 2014), competition and innovation have an inverted-U shaped relationship.

( The X-axis: the ratio of marginal cost to price. Left = less competitive; right= more competitive. The upper curve shows firms whose productivity levels are pretty similar; the lower curve is all firms, where productivity levels are diverse. )

Although it’s based on modern evidence from British firms, the inverted-U shape indeed suggests that too little competition discourages innovation, but so does too much competition. There is some optimal level in-between the two extremes.

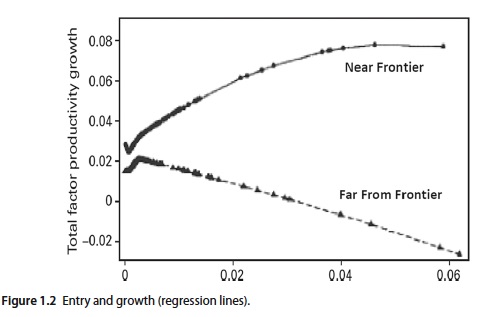

The graph below shows the impact of trade liberalisation on modern British firms (coincidentally!), with the X-axis representing the entry of foreign firms (i.e., more competition):

Although firms whose productivity is farther away from the frontier fall behind and are more likely to exit the market altogether, those closer to the frontier become even more efficient. (Aghion & Burgess present similar evidence from trade liberalisation for Britain and India.)

Although firms whose productivity is farther away from the frontier fall behind and are more likely to exit the market altogether, those closer to the frontier become even more efficient. (Aghion & Burgess present similar evidence from trade liberalisation for Britain and India.)

§ § § § §

We might speculate that a trade ‘liberalisation’ in Britain in the late 18th or early 19th century would have weeded out the smaller, less efficient firms in the cotton industry — those struggling with “a carding engine and a few jennies (or a mule or two) to maintain their place in the industry”.

At first the most efficient firms might have been forced to specialise in the coarser fabrics where India was no longer competitive. With more resources allocated to production and mechanisation at the lower end of the market, all the happy learning-by-doing and agglomeration economies might have generated new knowledge about machinery for weaving the finer fabrics. There certainly would have been an incentive to innovate in order to conquer the last redoubt of India’s market share.

So the net effect of the post-1774 tariffs might have been slower technological development and diffusion.

Pingback: The Calico Acts & British Cotton: infant industry protection from Indian competition??? | pseudoerasmus

Pingback: The Calico Acts: Was British cotton made possible by infant industry protection from Indian competition? | History on the mysteryStream